Common Stock: What It Is, Different Types, vs Preferred Stock

By admin

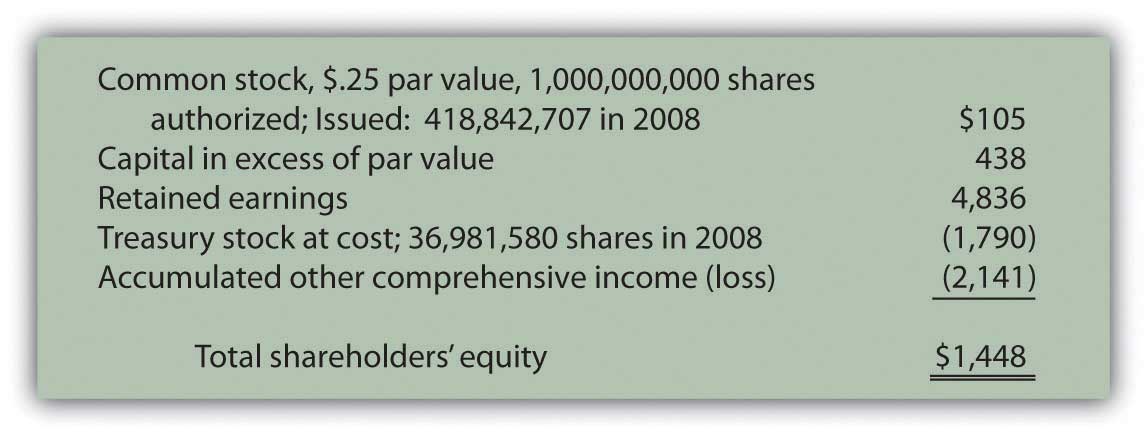

They carry greater risk than assets like CDs, preferred stocks, and bonds. Over the long term, stocks tend to outperform other investments but in the short term have more volatility. Now that we have an understanding of what shareholders’ Equity is, we can now show the entry of common stock in a balance sheet in the stockholders’ section of a financial statement. Common stockholders usually have the right to vote on major corporate decisions, such as electing the board of directors or approving mergers. This gives shareholders a level of influence over how the company is run, which preferred stockholders typically do not have. Investing in common stocks allows shareholders to benefit from the companies’ potential success through capital gains and, sometimes, dividends, although these are never guaranteed with common stock.

Trading and Price Changes

Because of their stable dividends and lower volatility, preferred stocks are often favored by institutional investors pursuing a predictable income stream. These stocks are also normally less liquid than common stocks, meaning they are traded less frequently, making them less suitable for retail investors looking for short-term gains. Unlike preferred stock, where dividends are fixed and paid regularly, dividends on common stock are not guaranteed. They depend on the company’s profitability and the decisions of the board of directors. In tough economic times, a company may reduce or eliminate dividends altogether, leaving common shareholders without a regular income stream. Preferred stockholders in these companies enjoy fixed dividends, typically at a higher rate than common stockholders, which makes it appealing to those looking for consistent returns.

How to Calculate Common Stock Outstanding From a Balance Sheet

Assets are things that could increase the value of a company over time, while liabilities are debts that must be paid or goods and services obligations that must be fulfilled. However, because of how they differ from common stock, investors need a different approach when investing in them. Both common stock and preferred stock have pros and cons for investors to consider.

- Without knowing which receivables a company is likely to actually receive, a company must make estimates and reflect their best guess as part of the balance sheet.

- Looking at the number of outstanding shares, the total number of shares authorized to issue, and the book value can tell you a lot about a company’s assets, liabilities, and overall financial health.

- The distinct features attached with common stock and preferred stock discussed above appeal to different classes of investors.

- This is where investors can determine the book value, or net worth, of their shares, which is equal to the company’s assets minus its liabilities.

What is the approximate value of your cash savings and other investments?

A company’s share price is often considered to be a representation of a firm’s equity position. Looking at the same period one year earlier, we can see that the year-over-year (YOY) change in equity was an increase of $9.5 billion. The balance sheet shows this increase is due to a decrease in liabilities larger than the decrease in assets.

Accounting For Stockholders’ Equity

These blue chip stocks are currently offering a great blend of quality and value. At Taxfyle, we connect individuals and small businesses with licensed, experienced CPAs or EAs in the US. We handle the hard part of finding the right tax professional by matching you with a Pro who has the right experience to meet your unique needs and will handle filing taxes for you. Sue-Lynn Carty has over five years experience as both a freelance writer and editor, and her work has appeared on the websites Work.com and LoveToKnow.

MANAGING YOUR MONEY

He has a liking for marketing which he regards as an important part of business success. He lives in Plateau State, Nigeria with his wife, Joyce, and daughter, Anael. Cash Dividends and Stock Dividends are not reported on the balance sheet. We also allow you to split your payment across 2 separate credit card transactions or send a payment link email to another person on your behalf.

It shows how much money was raised from selling shares to investors, often referred to as the common stock balance. This money is used to grow the company, pay for things it needs, or even pay off debts, ultimately benefiting common stockholders. Looking at the number of outstanding these 4 measures indicate that xero shares, the total number of shares authorized to issue, and the book value can tell you a lot about a company’s assets, liabilities, and overall financial health. It’s like a health check-up for the company, showing if it’s strong and healthy or if it has some work to do.

Following company financials is important, not only before you invest, but also on an ongoing basis. If something changes and an investment no longer fits your objectives and risk tolerance, it might be time to move on. We accept payments via credit card, wire transfer, Western Union, and (when available) bank loan.

Let’s say that Helpful Fool Company has repurchased 500 shares in this year’s buyback program. The company now has 5,000 authorized shares, 2,000 issued, 500 in treasury stock, and 1,500 outstanding. The outstanding stock is equal to the issued stock minus the treasury stock.

Once an IPO is complete, the common stock begins trading on the stock market. The balance sheet provides an overview of the state of a company’s finances at a moment in time. It cannot give a sense of the trends playing out over a longer period on its own.