What Is a Suspense Account? Purpose and Usage Explained

By admin

Transactions recorded in a suspense can relate to both debits and credits. A mortgage suspense account is a specific type of suspense account used in the world of home loans and mortgages. It is used exclusively for mortgage payments that cannot be fully applied to a loan account immediately. Let us understand how suspense account entries work and how it helps accounting teams with the help of a couple of examples. They ensure that you account for all transactions accurately in your books. You might be unsure about which department of your business to charge, so you place the amount in a suspense account.

Subsequent Entry

The term “suspense account” can have several different meanings, depending on the context. In the business world generally, a suspense account is a section of a company’s financial books where it can record ambiguous entries that need further analysis to determine their proper classification. A customer of ABC Ltd makes an online payment of 50,000 but he did not specify against which open invoice (out of the 20 open invoices) the amount needs to be settled. In this case, the accountant will pass the initial entry in the suspense account till he identifies the correct open invoice. The main purpose of setting up a suspense account is to keep track of temporary transactions that have not yet been posted to the ledger account. These temporary transactions are “suspended” or held in suspense until they can be identified with a specific ledger account.

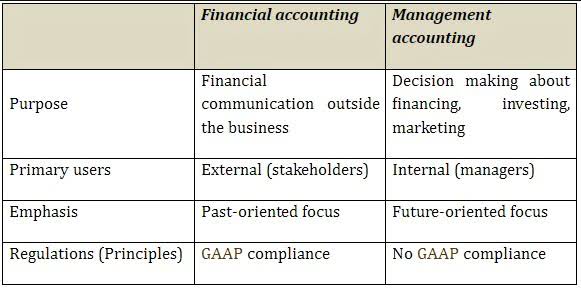

Accounting Ratios

A suspense account is a temporary holding account for all those “what on earth are these? It’s where unclassified entries, discrepancies, or incomplete information find a temporary home until their true identity is revealed. Explore the strategic role of suspense accounts in accounting, their resolution, and how they ensure accurate financial reporting. As cash has been received, an accounting entry will be recorded in the suspense account until the information regarding which invoice the payment is for is provided. Here are four common scenarios where suspense accounts are utilized, each presented with detailed journal entries suspense account to illustrate the proper accounting practices. Suspense accounts serve as temporary placeholders in accounting, helping to manage transactions that cannot be immediately classified or resolved.

Example of a Suspense Account

If a bookkeeper is unsure about which account to debit or credit in a transaction, they can temporarily place the entry in a suspense account. When an accounting error is identified, such as a misclassification of expenses, the incorrect entry would be moved to a suspense account while the error is investigated and then ultimately corrected. On 1 September 20X8, Michelle had a balance outstanding owed to one of her suppliers of $400.

What is your current financial priority?

You might receive a partial payment from a customer and be unsure about which invoice they’re paying. Hold the partial payment in a suspense account until you contact the customer. When you find out the invoice, close the suspense account and move the amount to the correct virtual accountant account. A suspense account is a general ledger account in which amounts are temporarily recorded.

Depending on the context, “suspense account” might mean a number of different things. In simple terms, a suspense account is a bookkeeping account wherein transactions are recorded before being assigned to the right category. A suspense account is a general ledger account prepared in the following situations;1.

Example #4 – Trial Balance

- If the credits in the trial balance are larger than debits, record the difference as a debit.

- By addressing these procedural gaps, organizations can reduce the volume of transactions that require suspense account classification, streamlining accounting operations and enhancing overall financial management.

- Later, the decision is made to charge 4/5 of it to carriage inward and the rest to carriage outwards.

- The reallocation is typically accompanied by a journal entry that provides a clear audit trail from the suspense account to the final destination in the ledger.

- Brokerage firms also use suspense accounts to, for example, keep track of a customer’s money between the time they sell an investment and when they reinvest that money.

- Despite its mysterious connotations, “suspense” in this case simply refers to the fact that a transaction or its designation in a company’s books has been suspended temporarily, pending some further action.

As you can see, there is now a nil balance carried forward in the suspense account. cash flow This is because unallocated transactions get more difficult to reconcile with passing time, especially if there is insufficient documentation, and the account balance could grow uncontrollably. Let’s suppose a company receives a cash sum of $500 but it cannot figure out who the money is from or what it is for.

Here are several common situations where we can utilize suspense accounts. Imagine you deposit money into your brokerage account to buy stocks, but there’s a delay in processing your investment choice, or there’s ambiguity about your instructions. Instead of this causing confusion or potential errors in your account, the funds are placed into a brokerage suspense account. This ensures that your money is safely held while any uncertainties are resolved. Sometimes, accounting teams don’t have all the necessary information for a particular transaction. Regardless of that, they need to record every transaction to keep their ledger books up to date, and this is where the suspense account comes in handy, as they are not sure where to record general ledger entries.