Statement Of Functional Expenses

By admin

The Statement of Functional Expenses is a specialized financial report used by nonprofit organizations that categorizes all organizational expenses according to their function. This statement is designed to provide transparency and detail on how funds are spent across different activities, distinguishing between program services, management and general operations, and fundraising efforts. Its primary purpose is to offer a clear view of the financial allocations that support direct mission activities versus those required for administrative and fundraising functions. This level of detail helps stakeholders evaluate the effectiveness and efficiency of the nonprofit in utilizing its resources towards achieving its mission. Program expenses are costs related to fulfilling the organization’s mission and programs. These are typically payroll expenses for employees who run the program(s), supplies for the program, and other direct program related activities.

Better money management = more money to manage.

- Many of your expenses (like salary, rent, and utilities) contribute directly to the execution of multiple functions.

- This also helps the organization in keeping a record of the usage of cash in each program, event, general, and other choruses.

- Your SFE is one of the four main statements you’ll utilize in your nonprofit, which also includes your Statement of Activities.

- Depending on the natural classification of the expense, different allocation methods may be appropriate.

A listing of the titles of the general ledger accounts is known as the chart of accounts. The items that cause the changes in Net Assets are reported on the nonprofit’s statement of activities (to be discussed later). Most state and federal documents virtual accountant that you will need to file to maintain your 501(c)(3) status will ask that you categorize expenses by function rather than nature. This provides transparency and shows how much of your funding is used on your mission-related activities vs. how much is used for the organization. The key to tracking functional expenses is setting up processes and being disciplined with your bookkeeping.

How Board Members, Donors, and Stakeholders Can Use the Statement

As a result, this ensures they direct the majority of their funds toward program services. Donors often look at the ratio of fundraising expenses to total expenses to gauge the efficiency of a nonprofit. As we have discussed above, a nonprofit has to record all its expenses in classifications. The functional expenses account is the record where accountants or bookkeepers classify and store all the functional expenses.

Create your own with our Statement of Functional Expenses Template

They also give donors and stakeholders a clear understanding of how they are using funds to serve the community or cause. To clarify, program Services Expenses are the costs directly related to carrying out a nonprofit’s mission or purpose. It might be hard to allocate salaries of some employees between program and management and general expenses. When you can’t determine whether something is a program expense or a m&g expense, QuickBooks then it should be automatically classified as an M&G expense. These costs are spent on this related to one department or segment in particular.

Activity-based budgeting and reporting also benefits the organization as it allows an organization to see its business model. Internally, it makes sense to expand activity allocations to show income as well as expenses related to each activity showing which activities generate a surplus or require subsidy. This report would more accurately be called a Statement of Activities by Class (function) or a Line Items by Activity Report. The functional areas included in the statement of functional expenses typically include programs, fundraising, and management and administration.

- Please contact Larson & Company with any questions you may have regarding allocating functional expenses in nonprofit organizations.

- The purpose is to allocate the cost to expense in order to comply with the matching principle.

- Under the accrual method of accounting, revenues are reported in the accounting period in which they are earned.

- It may also have 50 general ledger accounts for each of its major programs, plus many accounts under its fundraising and management and general expense categories.

- It might be hard to allocate salaries of some employees between program and management and general expenses.

- The required cost for the same can be counted on the basis of the area on square foot measurement.

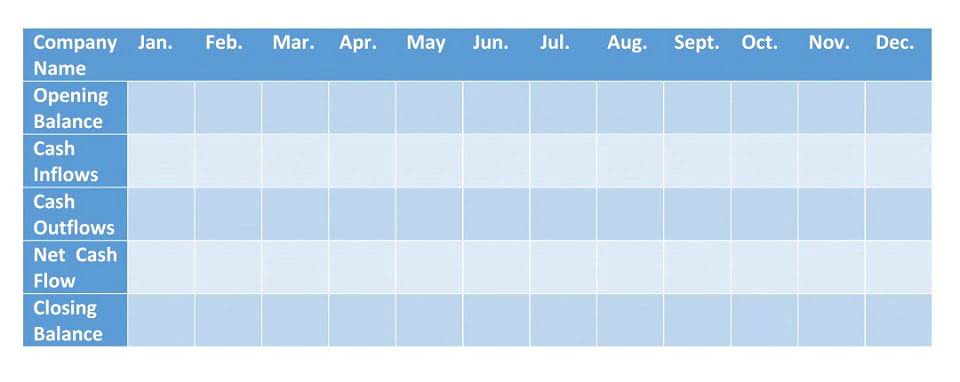

Statement of Cash Flow

To create your report with the template, list all your natural expense categories in the first column. 15% of your space (3,000/20,000) is used for admin, so you’d allocate 15% of your rent to general administration expenses. And the other 85% of your rent would be allocated to program expenses, as in the example above. Rather, it’s a way of looking at how you spent your money, according to the function that money accomplished. Functional expense reporting confuses many first-time nonprofit bookkeepers and executives.

- The Statement of Functional Expenses is a key component of a nonprofit organization’s financial reporting.

- The best way to ensure your statement of functional expenses meets reporting requirements and accurately represents your nonprofit’s spending is to work with a nonprofit accountant.

- Expensify can import these categories from any accounting system via a direct integration (e.g. QuickBooks Online, Xero, NetSuite, or Sage Intacct).

- For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- To clarify, program Services Expenses are the costs directly related to carrying out a nonprofit’s mission or purpose.

Here are some of the most important points from the article you cannot overlook. As per Financial Accounting Standards Board’s requirement, a nonprofit organization is supposed to categorize the expenses on the basis of its purpose. Natural expenditure here tells us about where the statement of functional expenses money went in respect to what in return.

It helps leadership understand the full costs of each function, which aids in strategic decision-making and budgeting. Each category plays a critical role in the overall sustainability and success of the organization, and understanding these components is crucial for anyone involved in managing, funding, or evaluating nonprofit entities. It is unique in its detailed breakdown, focusing solely on expenses rather than including income. This specificity allows for a deeper analysis of spending patterns and helps ensure that funds are being used appropriately and effectively. That part of the accounting system which contains the balance sheet and income statement accounts used for recording transactions.

What Is a Statement of Functional Expenses? A Quick Overview for Nonprofits

Line 13, office expenses, includes a few expenses that we typically see written out on line 24, but they qualify to be included in line 13. This line includes, office supplies, telephone expenses, postage and delivery expenses, shipping, equipment rentals, bank fees, and other similar costs. This schedule has provided 23 lines with specific descriptions and guidance of what expenses fall within each category. Then line 24, “other expenses” is where you would report any expenses that did not fall in any of the pre-listed descriptions. Do not include expenses on line 24 that fit into any of the categories on lines 1 to 23.